stock option tax calculator uk

Stamp Duty Reserve Tax SDRT when you. There are two types of stock options.

11 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

You can deduct certain costs of buying or selling your shares from your gain.

. If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Exercising your non-qualified stock options triggers a tax.

Nonqualified Stock Option NSO Tax Calculator. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Enter your option information here to see your potential savings.

The Stock Option Plan specifies the total number of shares in the option pool. When the option is exercised the option gain is subject to income tax up to 45 in the uk and 37 in the us. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant.

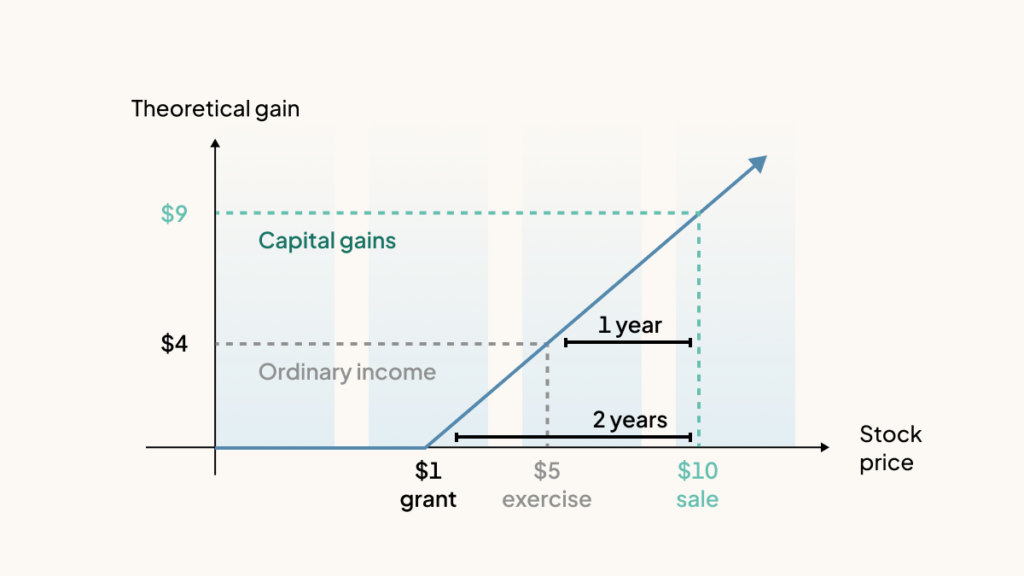

The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income. The strike price of 2500 1000 250 Taxes on your phantom gain of 750 10 - 250 for every exercised option. In particular stock trading tax in the UK is more straightforward.

This calculator illustrates the tax benefits of exercising your stock options before IPO. Alice now has a tax liability on the 25000 worth of stock which is taxed at the ordinary income rate. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a.

On this page is an Incentive Stock Options or ISO calculator. While if you hold that property or stock. Fees for example stockbrokers fees.

Learn to Trade XSP. If the scheme is unapproved then any money you. Exercise stock options buy.

The 42 best stock option tax. Nonqualified Stock Options NSOs are common at both start-ups and well established companies. Taxes for Non-Qualified Stock Options.

How much youre taxed. Lets say you got a grant price of 20 per share but when you exercise. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent.

The issue of stock options under an advantageous plan should also mitigate any social security payable. NSO Tax Occasion 1 - At Exercise. Short-term and long-term capital gains tax.

Options granted under an employee stock purchase plan or an incentive stock option iso plan are statutory stock options. When you exercise youll pay.

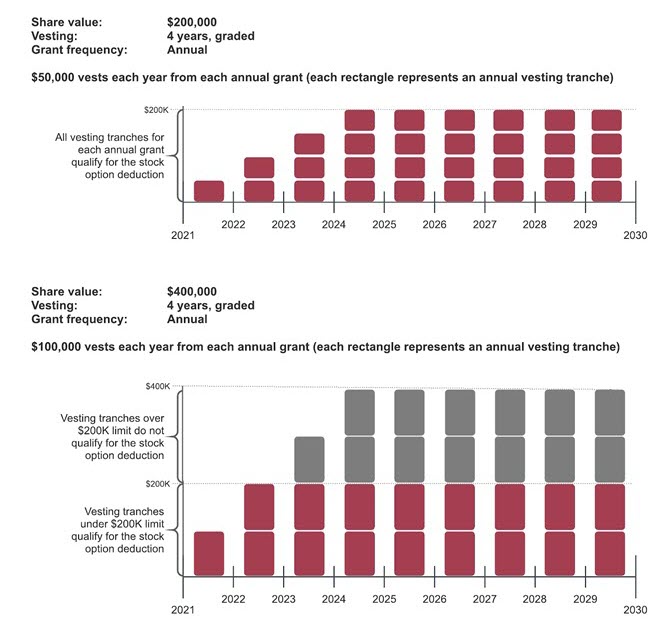

Tax Insights New Rules On The Taxation Of Employee Stock Options Will Be Effective July 1 2021 Pwc Canada

Nonqualified Stock Options And The Tax Impact Of Nsos Nerdwallet

Secfi Stock Option Tax Calculator

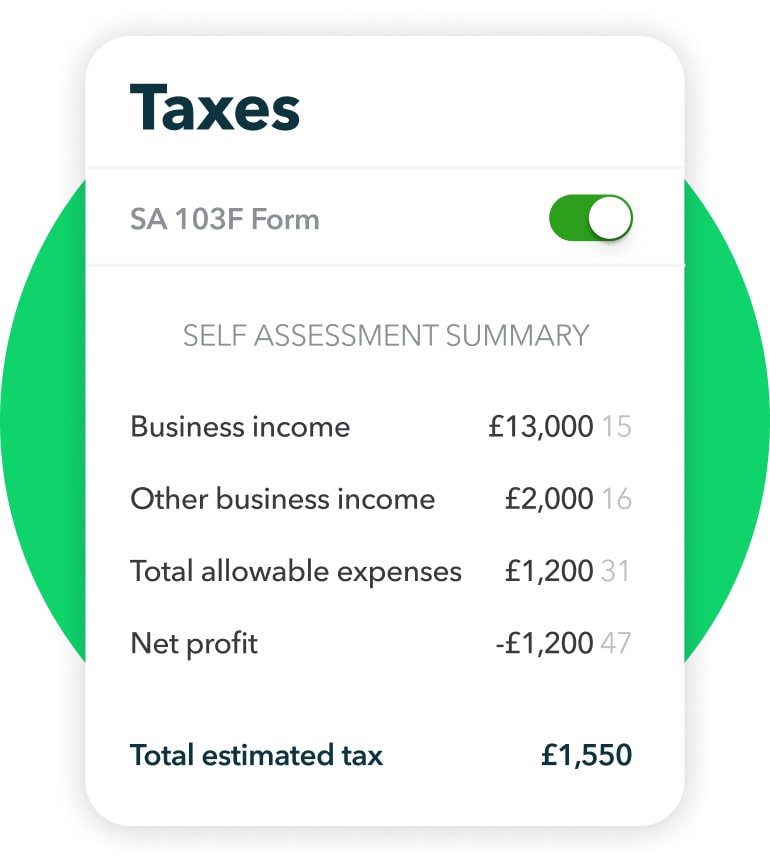

Hmrc Self Assessment Self Assessment Quickbooks Uk

Secfi Can You Avoid Amt On Iso Stock Options

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Capital Gains Github Topics Github

Best Crypto Tax Software Top Solutions For 2022

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

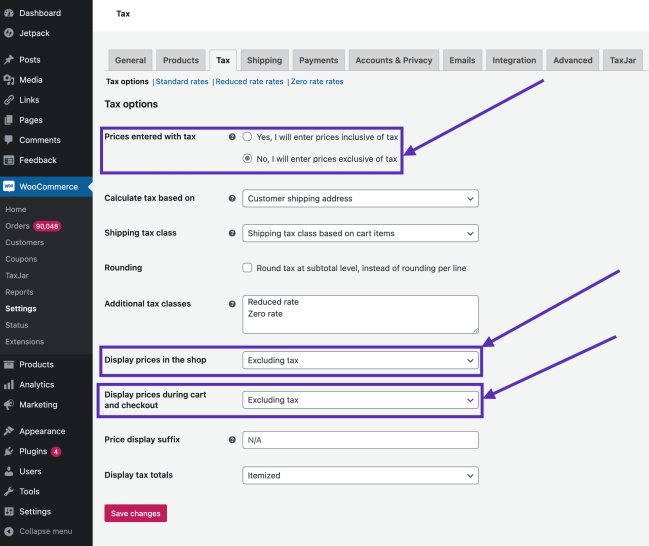

Setting Up Taxes In Woocommerce Woocommerce

Avoiding The Ten Year Stock Option Trap And Other Stock Option Considerations Kellblog

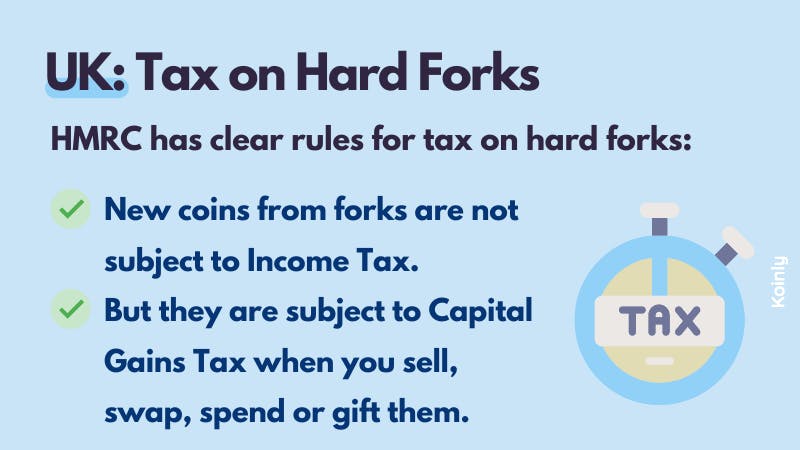

What Is A Crypto Fork Are Hard Soft Forks Taxed Koinly

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

How Are Stock Options Taxed Carta

Tax Calculator Uk Tax Calculators

How To Calculate Capital Gain Tax On Shares In India Eqvista

![]()

Uk Cryptocurrency Tax Guide Cointracker

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group